Valuables home insurance

You don't have to be a millionaire to need valuables home insurance.

How much contents insurance do I need?

It’s true, many people don't read their home insurance policy documents from cover to cover. But, if you have, you'll know most home insurance policies impose limits on the amount they'll pay out for individual items.

So, you may think that your priceless antique collection is covered, as your home contents policy pays out on contents up to £150,000, for example. Your actual cover amount will depend on your individual policy. However, if you read through the whole document, you may find the maximum amount your insurer pays out on one item is £2,000.

What are valuable items?

You don't need a Picasso on the wall to have a house full of valuable items. Some of the more common valuable items include:

• jewellery, gold and other precious metals

• art, and collectibles.

Anything in your home worth more than the maximum amount your insurance provider will pay out, either in total or for one item can be considered as a valuable item.

Do I need valuables home insurance?

If a standard home insurance policy isn't enough to protect your home or the things in it, there are specialist insurers who will provide cover.

This can range from separate insurances for jewellery, art, collections and specialist equipment, to buildings insurance for very large homes and estates.

If you have many valuable items, the insurer may only cover you if you have a suitable level of security at your home. They could ask you to fit a burglar alarm or a wall safe.

It's always wise to take precautions with your valuables. We recommend that you:

• Have your possessions regularly valued

• Keep copies of valuations and receipts away from the home

• Take photos as proof of ownership

Are both your building and contents covered?

-

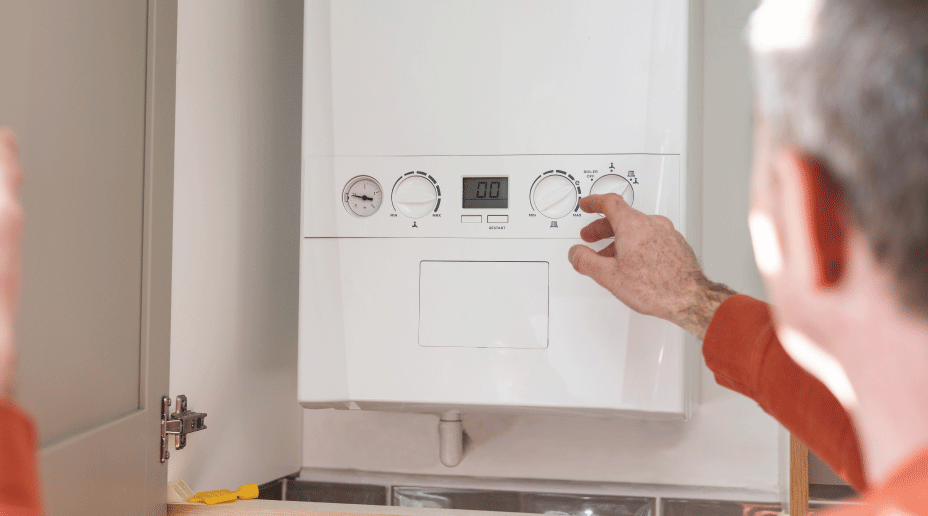

Buildings insurance

-

Contents insurance

This type of insurance covers you for rebuilding your home and all the essential fixtures and fittings inside.

Check your buildings insurance covers the cost of rebuilding your home. Some insurance policies only cover you up to £500,000 but we cover you up to £1 million on our Silver and Gold policies.

When it comes to buildings insurance, you only need to consider the rebuild cost, not the value of your property as it stands. So if you own a standard, modern three-bedroom house, our bronze policy may be enough to cover the rebuild cost with up to £500,000.

However, if you own a five-bedroom building, then you’re probably going to want to consider the higher level of cover offered by our silver and gold options.

That's why it's so important to give as much information as you can to your insurer about the type of property you live in. Because if you're not fully insured, you may be paying for any shortfall from your own pocket.

Allianz buildings insurance provides enough to rebuild many different types of properties and it allows for increases in the cost of rebuilding without reinsuring every few years.

This type of insurance covers all the furniture, carpets, televisions, entertainment equipment, computers and gadgets you have in your home, as well as any artwork, books, musical instruments and valuables.

With contents insurance, you need to be aware of the total amount you're insured for and the maximum amount the insurance company will pay out on any one item.

Check that the amount you're insured for covers the cost of replacing everything you own. From new sofas and beds to plates, glasses and cutlery. And especially those treasured items that may be hard to replace.

To make sure you're not underinsured, take a look at our tips for valuing your contents. As you go through each room, you can see how the total amount adds up.

And remember, whenever you upgrade your gadgets or inherit an expensive piece of jewellery, review your contents insurance to make sure you're still covered. If you need to increase your cover, most insurers will cover you for a small extra cost