Home insurance for new build properties

Spotless walls and floors. Windows and doors that keep out draughts and unwanted noise. A new kitchen and sparkling bathroom… now you just need insurance for your brand new home.

Check your new build warranty

About 70-80% of all new homes built in the UK are protected by an NHBC warranty or insurance policy. NHBC is the UK's leading independent standard-setting body and provider of warranties for new homes.

Many mortgage lenders won't lend on a new build home unless there's a Buildmark warranty in place. House builders registered with the NHBC have to meet certain build standards and their work is covered by the ten-year Buildmark warranty.

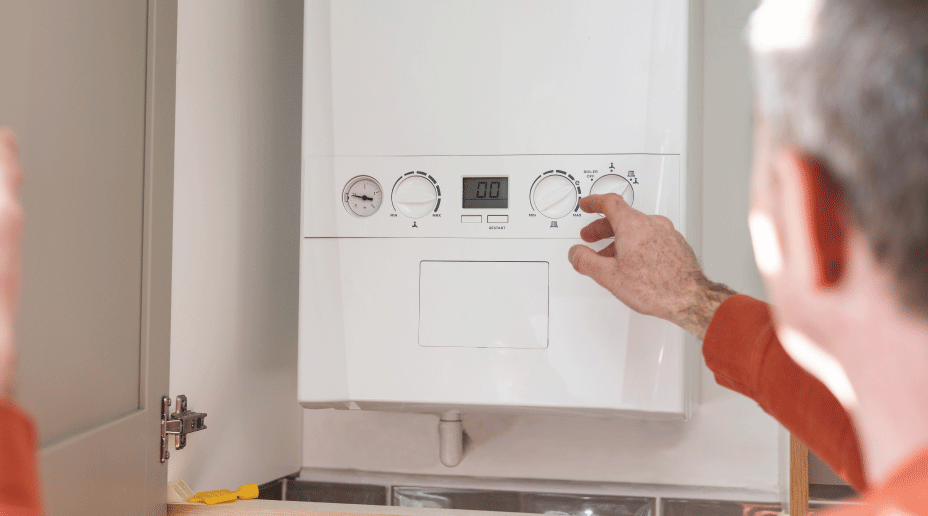

During the first two years of the warranty, the builder is liable for putting right any problems with your home, however big or small, if they have failed to comply with NHBC standards.

But if your new roof starts leaking because it gets hit by lightning – then what?

Buildmark doesn't protect against fire or flood

The NHBC Buildmark warranty only covers you against repairs to your home that need to be made because of poor workmanship. If anything else happens to your new build, for example flooding due to bad weather, the fabric of your home and all the lovely things inside aren’t covered by the ten-year warranty.

So, you'll need home insurance from the date you complete the sale. In fact, some mortgage lenders require you to have buildings insurance from the day you exchange contracts with the builder or developer.

Check out our handy article for more information on how to protect your home from flooding.

Protect your investment with new build home insurance

There are two types of insurance for your home – buildings insurance and contents insurance. You can buy them together or separately.

Buildings insurance helps pay for any damage to your property as a result of:

- fire, lightning, explosion or earthquake

- some water and oil leaks

- storm or flooding

- subsidence, heave or landslip

- theft and vandalism

- impact - such as a tree falling.

We cover you for damage not only to the house itself, but to gates and fences (not covered for flood and storm damage), private garages and outbuildings, drives and patios, swimming pools and tennis courts and even solar panels. It also includes your baths, basins and toilets.

Contents insurance helps pay for damage to the things in your home due to:

- fire, storm and flood

- accidents

- theft and vandalism.

Our contents insurance covers your household items, such as sofas and chairs, valuables, like jewellery and paintings and even office equipment. It also covers your TVs and tablets, cash, credit cards and bicycles. Plus you can add optional accidental damage cover for extra protection against DIY disasters.

I'm buying a newbuild home, when should I get buildings insurance?

Legal Expenses cover

Buying a new build property can be a complicated business and you may find yourself in a dispute with the builder through no fault of your own.

Legal expenses cover will help you pay for solicitor's fees if you have a good chance of a successful outcome for your case. It can help you protect your rights as a homeowner, such as disputing faulty workmanship or disagreements over boundaries.