DJ Insurance

Allianz Musical Insurance

As of 1 October 2024 Allianz Musical Insurance closed to new customers following the acquisition by Lark Music, a trading name of Howden UK Brokers Limited.

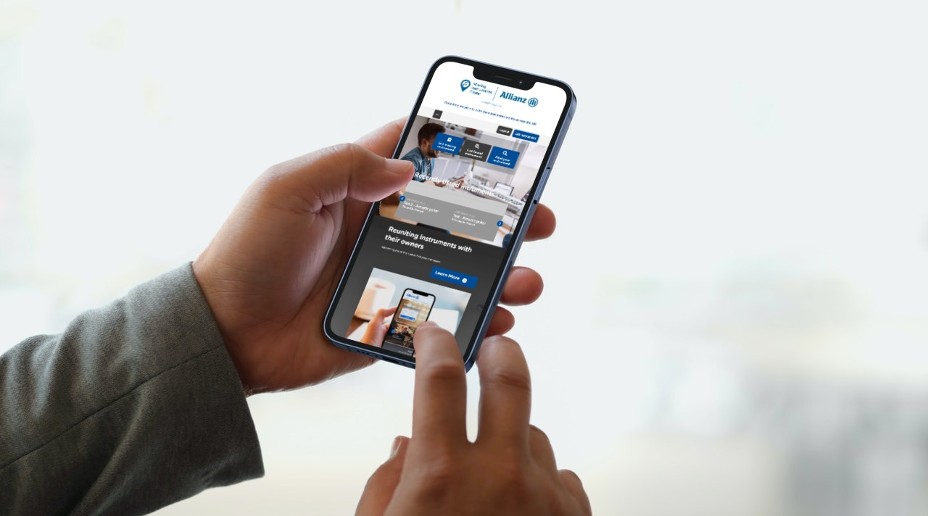

Protect your DJ equipment

Our DJ insurance will cover your equipment for accidental damage, theft, loss and more, meaning you can relax and perform, mix and produce without worries.

Our Public Liability insurance protects you against the cost of claims from third parties who might be accidentally injured when you record or perform. Our Personal Accident cover can provide financial benefits should you suffer an injury.

-

DJ Equipment & DJs

-

PA Systems

DJ Equipment & DJs

Whether you’re a part time disc jockey playing at home or a mobile DJ regularly mixing at the clubs, local pubs and weddings, we understand that protecting your DJ equipment is paramount.

Our DJ insurance will keep your gear covered so you can focus on the music and take some of the stress out of your night. We cover all your equipment, from your turntables to your headphones, mixer, and your laptop or iPad.

We even cover your music software and record collection and you'll get cover for accessories valued at a total of £500 or up to £250 each with your policy.

If you are performing in public, you might want to consider taking out Public Liability cover, to protect against claims from others who are accidentally injured or have their property damaged in connection with your musical activities. We offer cover limits from £1m to £10m, covering DJs working in the UK and Europe. Click here to find out more about Public Liability cover.

If you are a professional or semi-professional, our Personal Accident cover can provide financial benefits in the case you suffer accidental bodily injury. Unlike some competitors, our cover provides weekly payments if you are temporarily unable to perform your usual musical activities. Click here to find out more about our Musicians Personal Accident cover.

We set our prices for Public Liability and Personal Accident insurance based on how often you are active in public, so if you don’t perform very often, you will pay less, but can keep the convenience of an annual policy.

PA Systems

We know that the one-size-fits-all approach doesn't work for musicians, which is why our policies are flexible to for you. PA systems are used by lots of different musicians, whether it's for vocals, acoustic guitars or keyboards. We cover all PA and associated equipment, from your mics and amps to your headphones to speakers.

Our insurance will keep your gear covered so you can focus on the music and take some of the stress out of your gigs. Our insurance includes damage in transit cover and you can add on worldwide and unattended vehicle protection so you can make sure you've covered wherever you're performing.